Sales tax cut

Tuesday, October 09, 2018

|

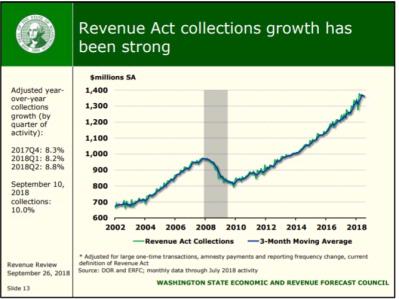

It is time to start talking about a state sales tax cut. According to WA’s September Revenue Forecast: “Forecasted Near GF-S revenue for the 2017-19 biennium is now $45.636 billion, 16.9% more than that of the 2015-17 biennium. Forecasted Near GF-S revenue for the 2019-21 biennium is now $49.806 billion, 9.1% higher than expected 2017-19 biennial revenue, and forecasted Near GF-S revenue for the 2021-23 biennium is $53.585 billion, an increase of 7.6% over expected 2019-21 biennial revenue.” As you can see from this chart from the revenue forecast, this means state revenues have continued to increase substantially: During this time of increasing revenue, however, the legislature has not provided significant tax relief to Washingtonians. Instead a large state property tax increase was imposed in response to the K-12 McCleary lawsuit (referred to as a property tax swap with local taxes reduced). With the state Supreme Court having signed off on the legislature’s McCleary plan and state revenues continuing to increase substantially, lawmakers should now provide tax relief with a sales tax cut. When it was first imposed in 1935, Washington’s sales tax rate was 2.0%. It is currently at 6.5% and has not seen a rate reduction since 1982. According to the state Department of Revenue, here are the potential 2019-21 taxpayer savings at various sales tax rate cuts: With the current projected increase in the state revenue forecast, lawmakers should consider a sales tax rate cut of at least 0.25%. A larger sales tax cut could be enacted via a trigger mechanism tied to any large revenue increases resulting from the new U.S. Supreme Court online sales tax ruling. Starting today the state Department of Revenue “will require some out-of-state retailers to begin collecting sales tax . . . This is a result of the U.S. Supreme Court’s June 21 decision in the South Dakota v. Wayfair case. The Wayfair decision allows states to require out-of-state businesses without a physical presence to collect and submit the tax on sales delivered into their state.” This U.S. Supreme Court ruling means the state has the potential to see even more growth in sales tax collections. This court ruling, coupled with the already substantial increases in state revenue, means it is time for lawmakers to prioritize tax relief with a reduction in the sales tax rate.